Billing Tab Overview

The Billing tab provides a unified view of all financial information for a customer, combining payment methods, transactions, and invoices into a single interface for efficient billing management.

Related documentation: Payment Methods , Transactions , Invoices , Payment Processing .

Accessing the Billing Tab

Per-Customer View:

- Navigate to Customers → [Select Customer]

- Click Billing tab

- View all three sections: Payment Methods, Transactions, and Invoices

System-Wide Views:

System-wide billing data can be accessed separately:

- Billing → Transactions - All transactions across all customers

- Billing → Invoices - All invoices across all customers

Self-Care Portal:

Customers accessing the Self-Care Portal see the same Billing tab structure:

- View and manage their payment methods

- View transaction history

- View and pay invoices online

Billing Tab Structure

The Billing tab is organized into three main sections, displayed as cards:

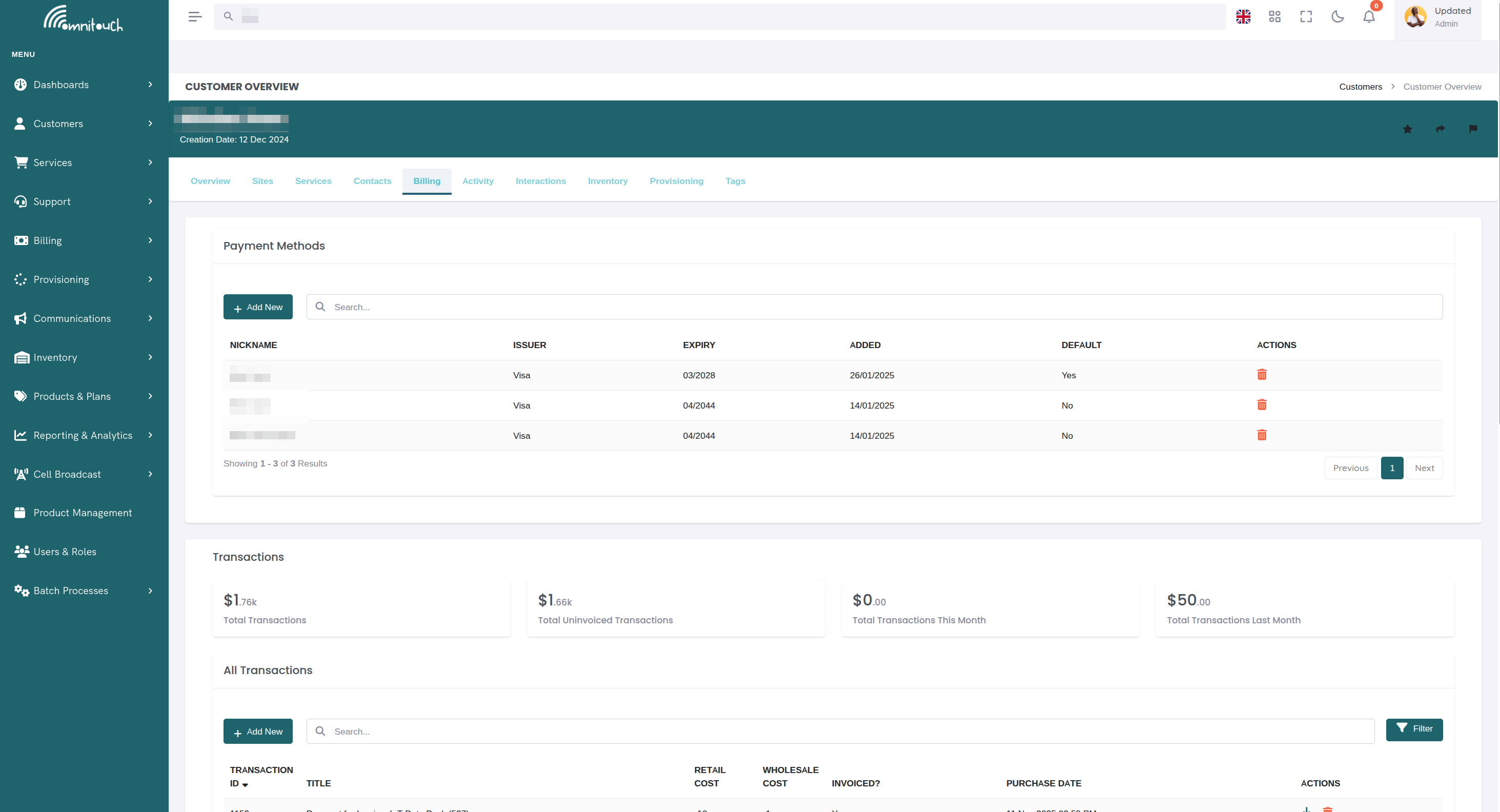

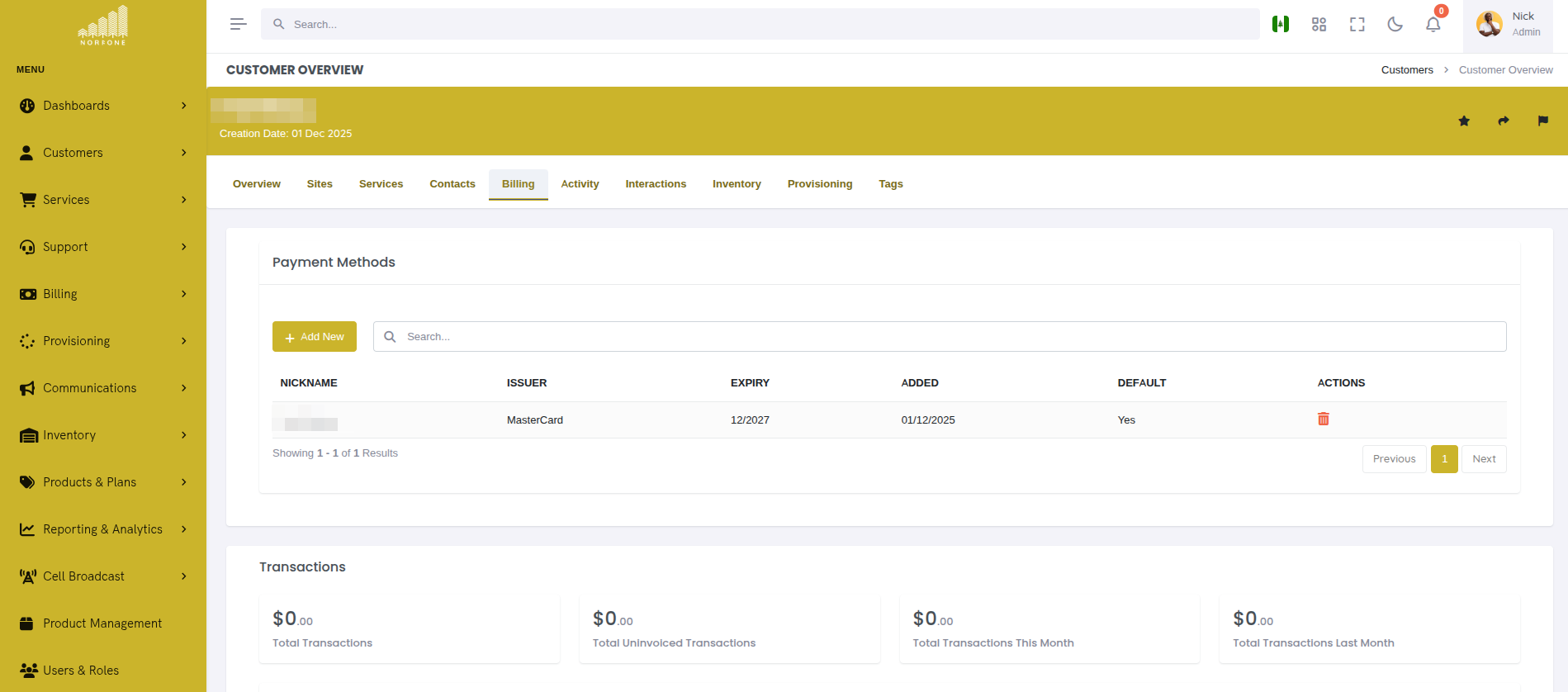

Section 1: Payment Methods

Purpose: Manage how customer pays for services

Key Features:

- View all saved credit cards

- Set default payment method

- Add new payment methods (via Stripe)

- Remove expired or unused cards

{.align-center

width="800px"}

{.align-center

width="800px"}

Documentation: basics_payment

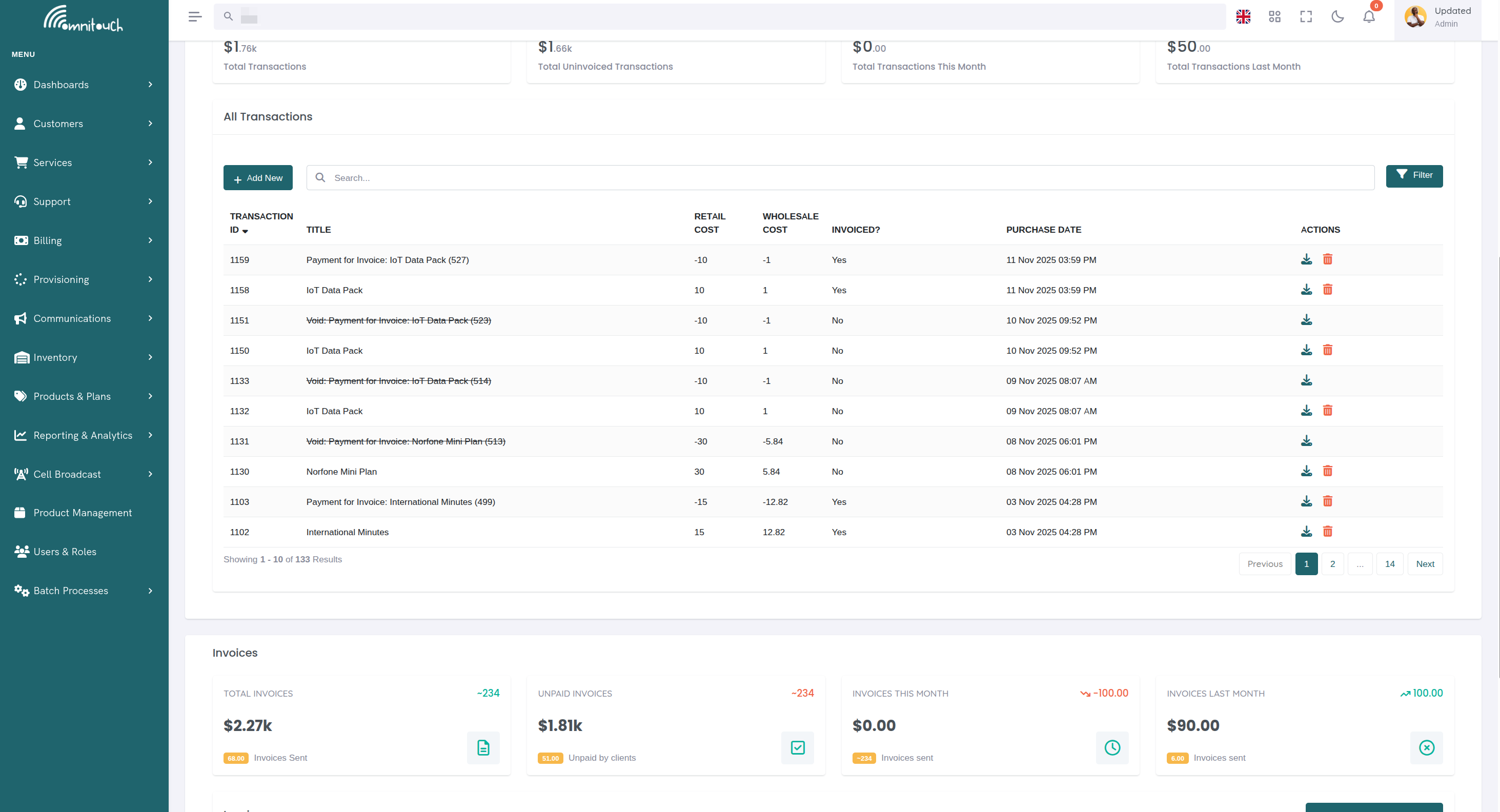

Section 2: Transactions

Purpose: Track all charges and credits for customer

Key Features:

- View transaction statistics (Total, Uninvoiced, This Month, Last Month)

- List all transactions with filtering by void/invoice status

- Add manual transactions (charges or credits)

- Void incorrect transactions

- See which transactions are invoiced vs uninvoiced

Documentation: payments_transaction

Section 3: Invoices

Purpose: Group transactions into bills for customer to pay

Key Features:

- View invoice statistics (Total, Unpaid, This Month, Last Month)

- List all invoices with filtering by paid/void status

- Generate new invoices from uninvoiced transactions

- Download invoice PDFs

- Email invoices to customers

- Pay invoices online (Stripe or manual payment methods)

- Void or refund invoices

Documentation: payments_invoices

Data Flow Between Sections

Understanding how data flows between the three sections is crucial for effective billing management.

Flow Diagram

Transaction → Invoice Relationship

1. Transaction Creation:

When a service is provisioned or a manual charge is added:

- Transaction created in Transactions section

- Transaction status: Uninvoiced

- Transaction's

invoice_idfield isnull

Example:

2. Invoice Generation:

When staff generates an invoice:

- Invoice created in Invoices section

- All uninvoiced transactions within date range grouped into invoice

- Transaction's

invoice_idfield populated - Transaction status changes to: Invoiced

Example:

3. Transaction Statistics Update:

- Uninvoiced Transactions total decreases

- Total Invoices statistic increases

- Unpaid Invoices total increases

Invoice → Payment Relationship

1. Invoice Payment:

When customer pays invoice:

- Payment processed using saved Payment Method (Stripe card)

- Or manual payment method selected (cash, POS, bank transfer)

- Invoice status changes to: Paid

2. Payment Transaction Created:

For manual payments (non-Stripe):

- Negative transaction created automatically

- Transaction title: "Payment for Invoice #1234"

- Transaction amount: -$45.00 (negative, credits customer)

- Transaction's

invoice_idfield: Links to paid invoice

Example:

3. Statistics Update:

- Unpaid Invoices total decreases

- Total Invoices This Month unchanged (invoice already existed)

Payment Method → Invoice Relationship

Stripe Payment Flow:

- Customer adds credit card in Payment Methods

- Card tokenized via Stripe, stored securely

- When paying invoice, customer selects saved card

- Stripe charges card

- Invoice marked as paid

payment_referencefield populated with Stripe payment intent ID

Manual Payment Flow:

- Customer pays via cash/POS/bank transfer (no payment method needed)

- Staff selects payment method in Pay Invoice modal

- Staff enters reference number (optional)

- Negative transaction created for payment amount

- Invoice marked as paid

Complete Billing Workflows

These workflows demonstrate how the three sections work together to accomplish common tasks.

Workflow 1: New Customer Setup and First Invoice

Goal: Set up billing for new customer and collect first payment

- Add Payment Method:

- Navigate to customer → Billing tab

- Payment Methods section → Click "Add Payment Method"

- Customer adds credit card via Stripe

- Card saved as default payment method

- Verify Transactions:

- Transactions section shows uninvoiced transactions:

- Service setup fee: $50.00

- First month service: $45.00

- Total Uninvoiced: $95.00

- Transactions section shows uninvoiced transactions:

- Generate Invoice:

- Invoices section → Click "Generate Proforma Invoice"

- Set date range to include setup and first month

- Click "Generate Invoice"

- Invoice #INV-2025-001234 created for $95.00

- Transactions Update:

- Both transactions now show: Invoice #INV-2025-001234

- Uninvoiced Transactions total now $0.00

- Email Invoice:

- Click email icon next to invoice

- Customer receives invoice email with PDF and pay link

- Customer Pays Online:

- Customer clicks pay link in email

- Redirected to Self-Care portal

- Click "Pay Invoice" button

- Select default payment method

- Click "Pay Invoice"

- Stripe charges card

- Invoice Update:

- Invoice status changes to "Paid"

- Unpaid Invoices total decreases by $95.00

Result: Customer fully set up with payment method, first invoice paid.

Workflow 2: Monthly Recurring Billing

Goal: Bill all customers for monthly service at end of month

- Services Auto-Charge:

- End of month arrives (January 31)

- Billing system automatically creates transactions for all recurring services

- Transactions section shows new uninvoiced transactions

- Review Uninvoiced Transactions:

- Navigate to Transactions section

- Filter: Invoice Status: Not Invoiced

- Review list of all transactions ready for billing

- Verify amounts and descriptions correct

- Generate Invoices:

- Navigate to Billing → Invoices (system-wide)

- For each customer (or use batch process):

- Click "Generate Proforma Invoice"

- Select customer

- Start Date: 2025-01-01

- End Date: 2025-01-31

- Due Date: 2025-02-15

- Click "Generate Invoice"

- Transactions Update:

- All transactions now linked to invoices

- Uninvoiced Transactions totals reset to $0.00

- Email All Invoices:

- For each invoice, click email icon

- All customers receive monthly invoices

- Customers Pay:

- Customers with saved payment methods pay online via Self-Care

- Staff processes cash/POS payments for customers who pay in person

- Unpaid Invoices total decreases as payments received

Result: All customers billed for January, invoices sent, payments processed.

Workflow 3: Handling Service Issue Credit

Goal: Credit customer for service outage, apply to unpaid invoice

- Customer Reports Issue:

- Service was down for 2 days

- Customer deserves $10 credit

- Add Credit Transaction:

- Navigate to customer → Billing tab → Transactions section

- Click "+ Add Transaction"

- Transaction Type: Credit

- Credit Type: Cash Payment (or appropriate type)

- Title: "Service Outage Credit"

- Description: "Compensation for 2-day outage 8-9 Jan"

- Retail Cost: 10.00

- Click "Add Transaction"

- Transaction Created:

- Transaction appears in list with amount: -$10.00

- Transaction status: Uninvoiced

- Uninvoiced Transactions total now includes -$10.00

- Apply to Invoice:

- If customer already has unpaid invoice:

- Invoice remains unpaid with original amount

- Credit will be applied to next invoice generation

- If generating new invoice:

- Invoices section → Click "Generate Proforma Invoice"

- Include date range with credit transaction

- Invoice generated with credit applied:

- If customer already has unpaid invoice:

- Customer Pays:

- Customer pays reduced amount: $35.00

- Invoice marked as paid

Result: Customer credited for outage, credit applied to next invoice, lower payment collected.

Workflow 4: Payment Method Expired - Update and Retry

Goal: Customer's card expired, causing payment failure - update card and retry payment

- Payment Failure Notification:

- Customer attempts to pay invoice

- Stripe returns error: "Card expired"

- Payment fails, invoice remains unpaid

- Update Payment Method:

- Customer navigates to Billing tab

- Payment Methods section → Click "Add Payment Method"

- Enter new card details (updated expiry date)

- New card saved

- Set as Default:

- Customer clicks "Set as Default" on new card

- Old card removed automatically (if desired)

- Retry Payment:

- Navigate to Invoices section

- Locate unpaid invoice

- Click "Pay" icon

- Payment modal opens with new default card pre-selected

- Click "Pay Invoice"

- Stripe charges new card successfully

- Invoice Update:

- Invoice status changes to "Paid"

payment_referencefield populated with new Stripe payment intent ID

Result: Customer updated payment method, invoice successfully paid with new card.

Workflow 5: Voiding Incorrect Invoice and Re-Billing

Goal: Staff generated invoice with wrong transactions - void and regenerate correctly

- Error Discovered:

- Invoice #INV-2025-001234 generated with wrong date range

- Included transactions from wrong month

- Invoice is unpaid

- Void Invoice:

- Navigate to Billing tab → Invoices section

- Locate incorrect invoice

- Click delete icon (🗑️)

- Confirm void

- Invoice voided

- Transactions Released:

- Navigate to Transactions section

- All transactions from voided invoice now show: Uninvoiced

- Uninvoiced Transactions total increases

- Transactions available for new invoice

- Generate Correct Invoice:

- Invoices section → Click "Generate Proforma Invoice"

- Set correct date range

- Apply filter if needed (e.g., "Mobile" for mobile-only invoice)

- Click "Generate Invoice"

- New invoice created with correct transactions

- Verify and Email:

- Review new invoice details

- Verify correct transactions included

- Click email icon to send to customer

Result: Incorrect invoice voided, transactions re-invoiced correctly, customer receives corrected invoice.

Workflow 6: Processing Cash Payment for Multiple Invoices

Goal: Customer pays multiple unpaid invoices with single cash payment

- Customer Arrives with Cash:

- Customer brings $300 cash to pay outstanding invoices

- Navigate to customer → Billing tab

- Review Unpaid Invoices:

- Invoices section → Filter: Paid: Not yet Paid

- View unpaid invoices:

- Pay First Invoice:

- Click pay icon on invoice #1234

- Payment modal opens

- Select "Cash" payment method

- Enter reference: "Cash paid 2025-02-10 - Receipt #001"

- Click "Pay Invoice"

- Invoice #1234 marked as "Paid"

- Pay Remaining Invoices:

- Repeat process for invoice #1235:

- Reference: "Cash paid 2025-02-10 - Receipt #001"

- Repeat for invoice #1236:

- Reference: "Cash paid 2025-02-10 - Receipt #001"

- Repeat process for invoice #1235:

- Verify Transactions:

- Navigate to Transactions section

- Three new payment transactions created:

- All linked to respective invoices

- Update Statistics:

- Invoices section → Unpaid Invoices total decreased by $300.00

- All invoices now show "Paid" status

Result: Customer paid all outstanding invoices with cash, payment transactions recorded with receipt reference.

Best Practices

For Staff Users

Transaction Management:

- Add manual transactions immediately (don't delay)

- Use descriptive titles and descriptions for clarity

- Link transactions to services and sites when applicable

- Void incorrect transactions before they're invoiced

Invoice Generation:

- Generate invoices at consistent intervals (e.g., monthly on 1st of month)

- Use date ranges carefully to avoid overlap or gaps

- Use filters to create service-specific invoices when needed

- Email invoices immediately after generation

- Review invoice PDFs before sending to customers

Payment Processing:

- Verify payment method valid before attempting charge

- Always enter reference numbers for manual payments (cash, POS, bank transfer)

- Mark invoices as paid immediately after receiving payment

- Refund via Stripe only (create manual credit for other payment methods)

Data Hygiene:

- Regularly review uninvoiced transactions

- Investigate void transactions to understand billing errors

- Monitor unpaid invoices and follow up with customers

- Keep payment methods current (remove expired cards)

For Customers (Self-Care Portal)

Payment Methods:

- Keep at least one valid payment method on file

- Update payment methods before cards expire

- Set your preferred card as default

Invoice Payments:

- Pay invoices before due date to avoid late fees

- Review invoice details and transactions before paying

- Download invoice PDFs for your records

- Contact support immediately if invoice appears incorrect

Transaction Review:

- Regularly review transaction history

- Report any unexpected charges immediately

- Understand which transactions are invoiced vs uninvoiced

For Administrators

System Configuration:

- Configure Mailjet email templates for professional invoice delivery

- Customize invoice PDF templates to match branding

- Set up Stripe integration for secure payment processing

- Configure payment terms and due dates

Monitoring and Reporting:

- Use statistics widgets to monitor billing health

- Track Uninvoiced Transactions total - should decrease after billing cycle

- Monitor Unpaid Invoices total - follow up on overdue payments

- Review This Month vs Last Month statistics for trends

Automation:

- Automate recurring service charges via product configuration

- Set up automatic invoice generation for recurring billing (if available)

- Configure email reminders for overdue invoices

Common Issues and Solutions

Issue: Customer Cannot Pay Invoice

Symptoms:

- Customer clicks pay button but nothing happens

- Error message: "No payment methods found"

Diagnosis:

- Navigate to customer → Billing tab → Payment Methods section

- Check if customer has any saved payment methods

- Check if saved cards are expired

Solution:

- Customer must add valid payment method before paying invoices

- Guide customer to Payment Methods page to add credit card

- Verify card accepted (Visa, Mastercard, Amex, etc.)

- Retry payment after card added

Issue: Invoice Generated with Wrong Transactions

Symptoms:

- Invoice includes transactions from wrong period

- Invoice missing expected transactions

- Invoice total incorrect

Diagnosis:

- Open invoice in Invoices section

- Review transactions included in invoice

- Check transaction dates vs invoice date range

- Check if filter was applied during generation

Solution:

- If invoice unpaid: Void invoice, verify transactions uninvoiced, regenerate with correct date range

- If invoice paid: Cannot void - create credit transaction for incorrect amount, generate corrected invoice

- Prevention: Always review Transactions section before generating invoice to verify correct transactions will be included

Issue: Uninvoiced Transactions Total Not Decreasing

Symptoms:

- Uninvoiced Transactions widget shows high amount

- Transactions list shows many uninvoiced transactions

- Monthly invoices already generated

Diagnosis:

- Filter transactions by Invoice Status: Not Invoiced

- Review list of uninvoiced transactions

- Check transaction dates - may be recent charges after last invoice generation

- Check if some transactions are voided (should not count toward uninvoiced total)

Solution:

- Expected behavior: Transactions created after last invoice generation remain uninvoiced until next billing cycle

- If old transactions uninvoiced: Generate invoice for those transactions with appropriate date range

- If voided transactions counted: System should exclude voided transactions automatically - report bug if not

Issue: Payment Method Keeps Declining

Symptoms:

- Stripe payment fails with "Card declined"

- Customer reports card should work

- Multiple retry attempts fail

Diagnosis:

- Check Stripe dashboard for decline reason

- Common decline reasons:

- Insufficient funds

- Card expired

- Card reported lost/stolen

- Bank fraud prevention

- International card blocked

Solution:

- Ask customer to contact their bank to authorize payment

- Try different payment method (different card)

- For staff: Process as manual payment (cash, POS) and mark invoice paid

- Verify billing address matches card billing address

Keyboard Shortcuts and Tips

Navigation:

- Access billing tab quickly: Customer page → B key (if keyboard shortcuts enabled)

Filtering:

- Transactions: Click "Not Invoiced" filter before generating invoices to see exactly what will be included

- Invoices: Click "Not yet Paid" filter to see all outstanding invoices requiring follow-up

Bulk Operations:

- Select multiple invoices (checkbox) to delete/void multiple at once (staff only)

- Use search bar to quickly find specific transaction or invoice by ID

Quick Actions:

- Click transaction/invoice title to view full details in modal

- Right-click actions menu (⋮) for quick access to download/email/pay options

Related Documentation

basics_payment- Payment methods and Stripe integrationpayments_transaction- Transactions in detailpayments_invoices- Invoices in detailintegrations_mailjet- Email invoice deliverycsa_activity_log- Viewing billing activity history